Anabolika zum Abnehmen: Chancen und Risiken einer Kur

август 27, 2025Transformations in the Global Economy: New Opportunities and Challenges

август 28, 2025Straight-line Depreciation Definition & Examples

These double entries are intended to replicate the continuous use of mounted property over time. We know that asset depreciation applies to capital expenditures, or items of equipment or machinery that might be used to generate earnings on your group over a number of years. The straight-line methodology is advised additionally as a result of it presents calculation most simply.

Threat Administration And Monetary Planning

- However, the corporate realizes that the equipment might be useful just for 4 years as an alternative of 5.

- Money circulate is the lifeblood of any enterprise, particularly for small enterprises that operate on tight…

- That firm might have the best sense of data based on their prior use of vans.

- This technique is an accelerated depreciation technique as a outcome of extra expenses are posted in an asset’s early years, with fewer expenses being posted in later years.

- In this guide, we’ll break down what salvage value is, why it’s essential, how it’s calculated, and the means it ties into totally different depreciation methods—all in simple terms.

In other words, it’s the price a company can sell it for, either as a working asset or as scrap. Businesses https://www.kelleysbookkeeping.com/ use salvage worth in accounting to determine how a lot depreciation to document through the years. Understanding and precisely calculating salvage worth is crucial for effective asset administration, ensuring compliance with accounting requirements, and optimizing financial performance. With a large quantity of manufacturing businesses relying on their machinery for sustained productivity, it’s crucial to keep assessing the tools they personal.

What If The Salvage Worth Of Any Asset Is Zero?

It represents the quantity that an organization could sell the asset for after it has been totally depreciated. On the opposite hand, e-book value is the value of an asset because it salvage value depreciation formula seems on a company’s steadiness sheet. It is calculated by subtracting accrued depreciation from the asset’s authentic value.

Common Strategies Of Depreciation

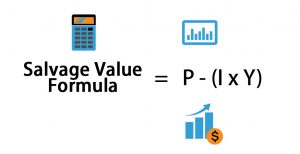

If your company uses a piece of kit, you need to see extra depreciation if you use the equipment to produce extra units of a commodity. If production declines, this technique lowers the depreciation bills from one yr to the next. To calculate salvage value, you will have to know the purchase value, useful life, and depreciation method used. The selection of depreciation method and understanding the tax implications of salvage value are essential for strategic monetary planning. Companies should weigh the benefits of quick tax deductions towards the potential future tax liabilities to optimize their tax position.

It is essential to seek the guidance of with a tax skilled to make sure compliance with native tax legal guidelines. The calculation of salvage value is a vital aspect of asset management and monetary planning, particularly in businesses the place belongings depreciate over time. The salvage worth is the estimated residual value of an asset at the end of its useful life.